- B2C

- FinTech

- Personalization

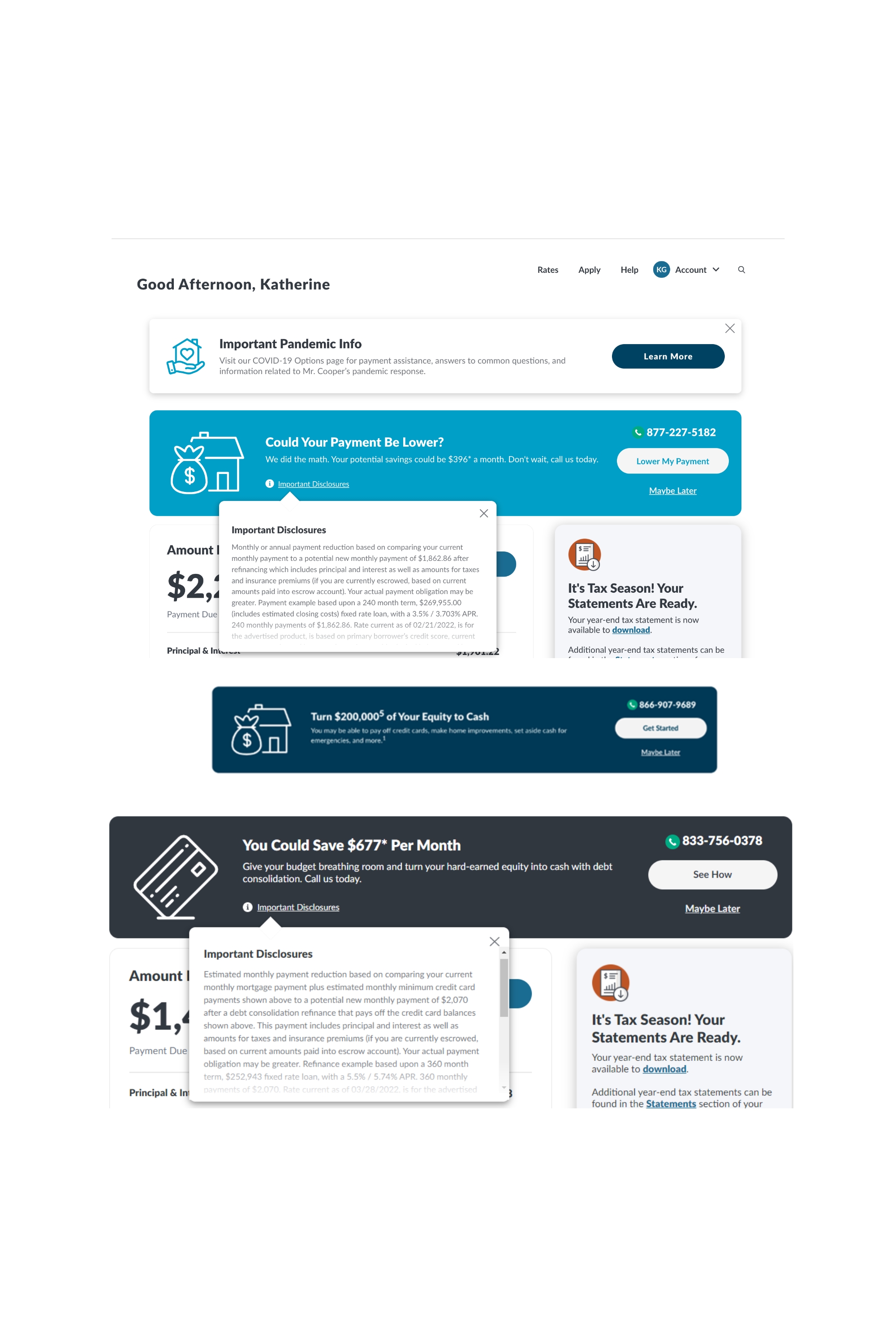

Personalization drives engagement and lead conversion. Yet, it's one thing to let the personalization engine run quietly in the background and another to "show your work" to the customer. We wanted to display compelling, personalized calculations to our logged-in customers, like showing how much they can tap into their equity or save monthly by consolidating debt.

It was important to do this both thoughtfully and in compliance. For example, if someone could only tap into $10-20K of equity, would this offer compel them to act? Would savings of $100 a month be worthwhile to someone considering refinancing?

I partnered with the Product, Data and Legal teams to define these parameters and launch personalized offer banners for debt consolidation and equity. Click-through rates delivered: personalized offers increased engagement by over 40% and yielded 25% more leads MoM. This was an exciting roll-out that got my wheels spinning about how else we can leverage data to serve the customer and drive growth.